How To Open Long Trigger Positions?

A-董天

Updated at: 2 days ago

How To Open Long Trigger Positions?

Future Trading is all about increasing your potential, and with BitNasdaq cryptocurrency exchange you can now make it happen. BitNasdaq is built on the idea of user-centricity and an easy trading experience. With this idea, BitNasdaq has build its Future Trading feature. Future Trading allows users to take even bigger leverage with some up to 100X. This makes the traders profit potential quite big. In Future Trading, traders don’t buy the actual underlying asset, but rather the underlying contract of that asset, predicting on the price increase or decrease.

What Are Open Long Orders?

Open Long Orders essentially mean buying a Future contract, with the prediction that the price of the underlying cryptocurrency will go up in the future. Traders who Open Long positions in Future Trading are mainly betting on the price increase, where they can sell the contract later at a higher price.

BitNasdaq cryptocurrency exchange has an easy and use-centric interface for both the BitNasdaq Website and the BitNasdaq App. Let’s go through the step-by-step guide for Open Long Trigger Orders via the website and the app.

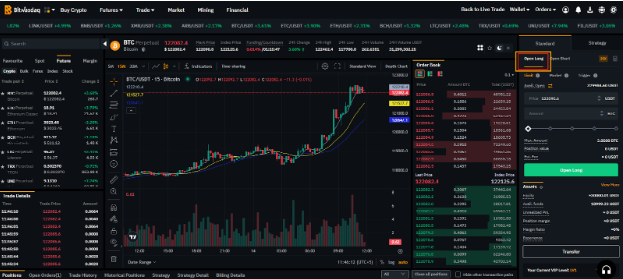

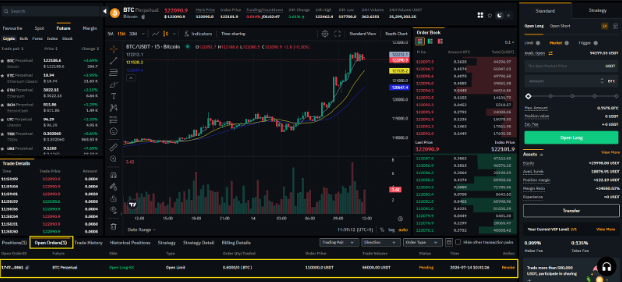

Open Long Trigger Positions Via BitNasdaq Website

Follow these step-by-step instructions to Open Long Trigger Position on the BitNasdaq website:

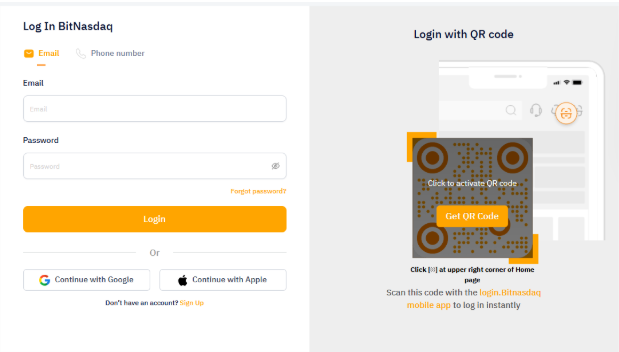

Log in to your BitNasdaq account on the BitNasdaq website at www.bitnasdaq.com.

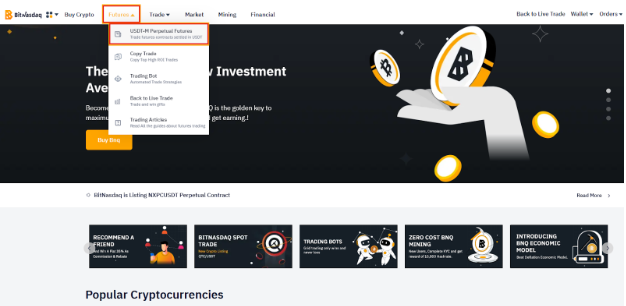

On the header, click on Futures, and in the dropdown menu select USDT-M Perpetual Futures.

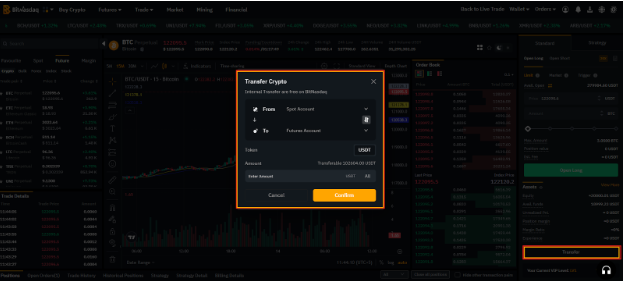

Next click on Transfer button to transfer funds, USDT, to your Future Wallet.

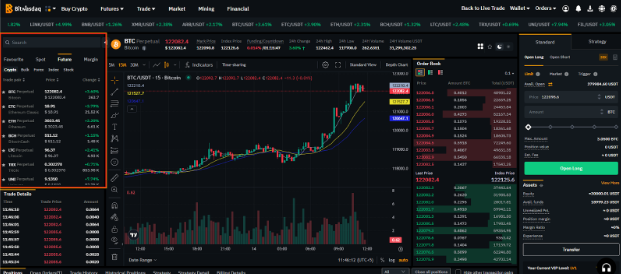

Once you have USDT in your Future Wallet, choose the Perpetual Coin to trade from the listings.

Next click on the Open Long option to start with Open Long.

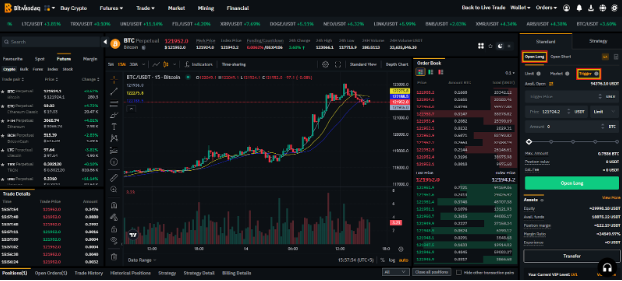

Now here in the order type choose Trigger, to start with Open Long Trigger position.

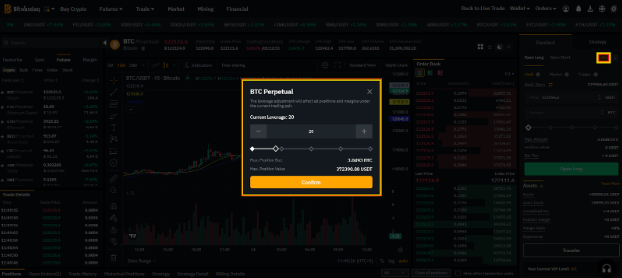

Next click on Leverage, to adjust your Leverage for the position according to your strategy.

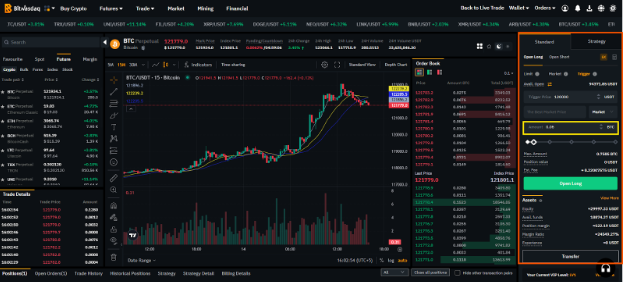

Once you have set your leverage, set your Trigger Price for the position. This is the price at which your Open Long order will be added to the order book but will remain inactive.

Next you have to either set your Limit Price or Market Price. This is the price at which you want your order in the order book to be active.

Next enter the amount asset contract you want to trade, example amount of BTC.

Double check all the details and click on Open Long button.

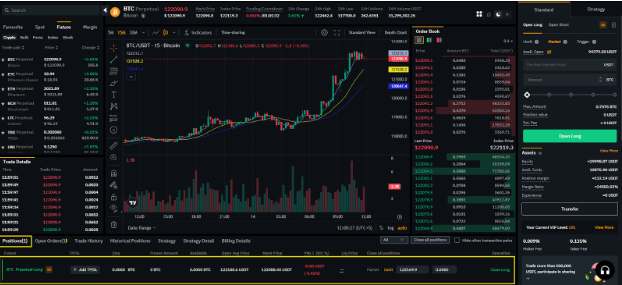

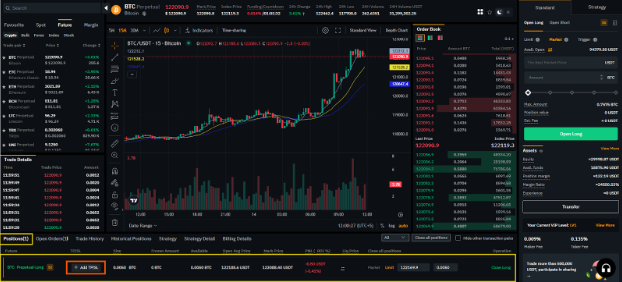

Your order will be added to Open Orders, until the market reaches your entered price.

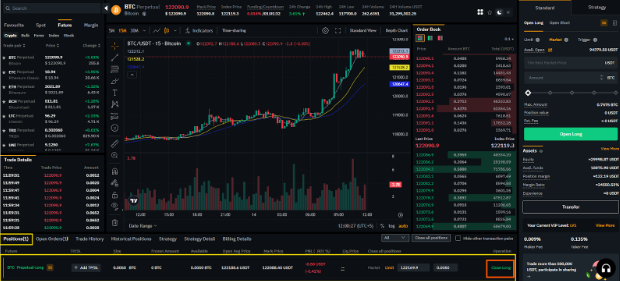

Once your price is met, the order will enter Position, where it will be actively traded.

Traders can also add Stop-Loss and Take-Profit to their trades.

Traders can also revoke any position at any time, by clicking on the Close Position button.

Open Long Trigger Positions Via BitNasdaq App

Follow these step-by-step instructions to Open Long Trigger Position on the BitNasdaq app:

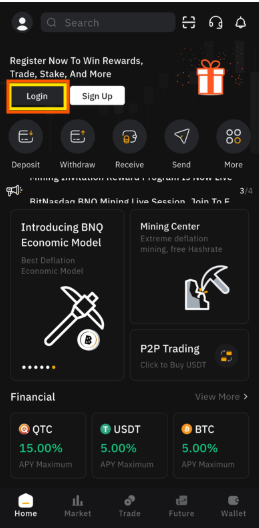

Download the BitNasdaq app and login to your BitNasdaq account.

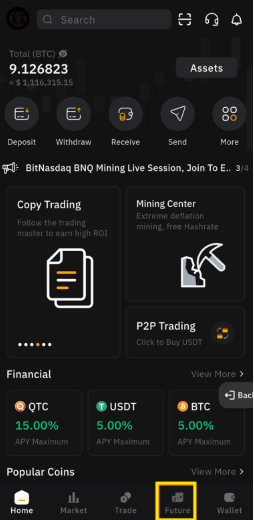

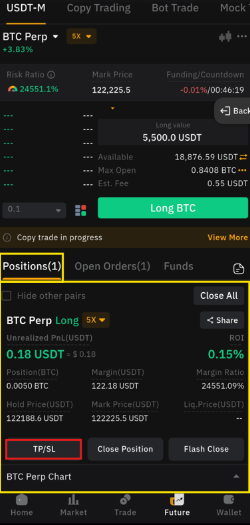

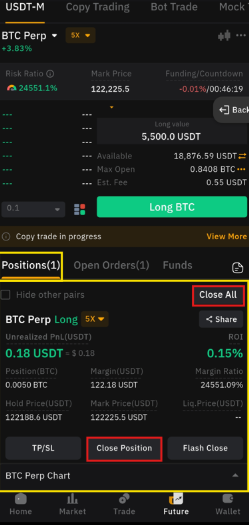

Once logged in, in the bottom menu, tap on the Future tab.

Next tap on the Transfer icon to transfer funds, USDT, to your Future Wallet.

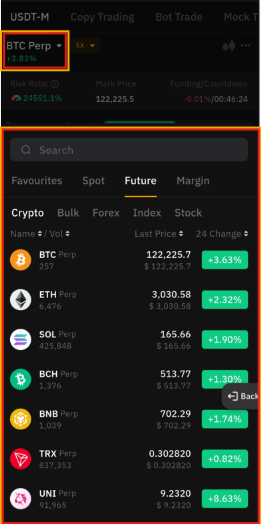

Once you have USDT in your Future Wallet, tap on the Perpetual Coin name on the top left corner, here select the Perpetual Coin to trade from the listings.

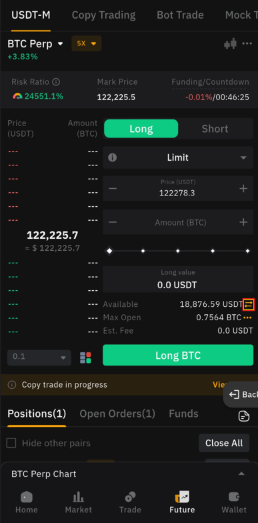

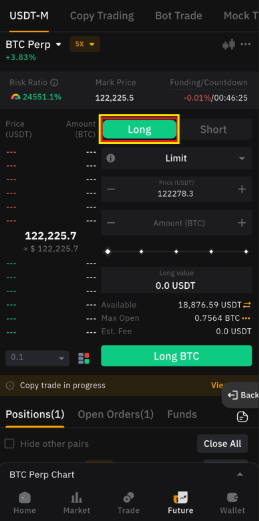

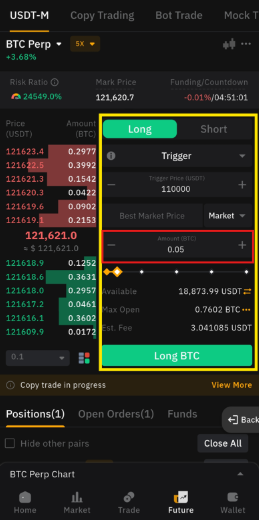

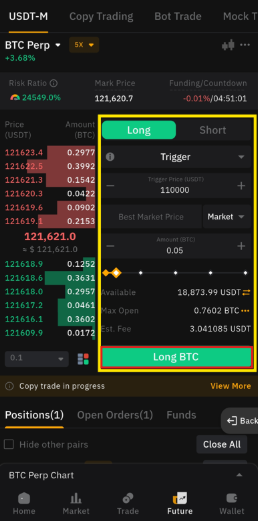

Next tap on the Long tab, to start with Open Long.

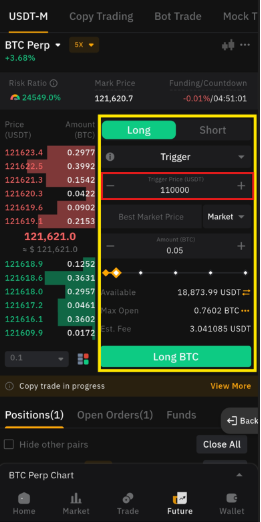

Next choose you order type as Trigger, to start with Open Long Trigger position.

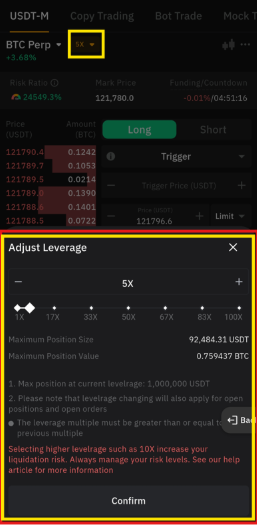

Now tap on Leverage, to adjust your Leverage for the position according to your strategy.

Once you have set your leverage, set your Trigger Price for the position. This is the price at which your Open Long order will be added to the order book but will remain inactive.

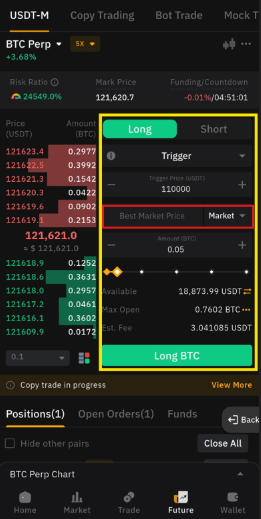

Next you have to either set your Limit Price or Market Price. This is the price at which you want your order in the order book to be active.

Next enter the amount asset contract you want to trade, example amount of BTC.

Now double check all your entered data and tap on the Long button.

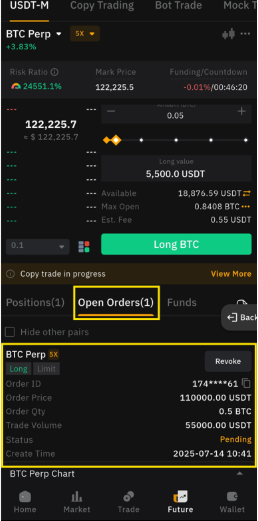

Your order will now be added to Open Orders tab, until the market price reaches your entered price.

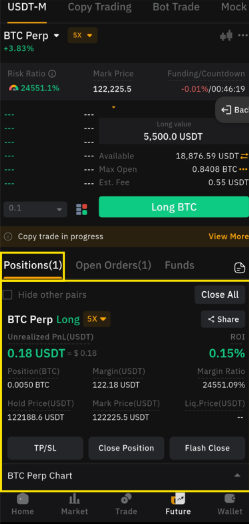

Once the market reaches your entered price the order will automatically go to open Positions and become active.

Here you can also add Stop-Loss and Take-Profit to the trade.

Traders also have the option to close any position by clicking on the Close Position button.

BitNasdaq Future Trading is simple, easy, and intuitive for users to execute. With multiple guides, and tool tips, users can stay gather all the necessary information for the trade. Traders can also use the calculator feature available to evaluate their trade strategy before opening the position.

Trade Futures on BitNasdaq today, with high leverage and a liquid market, it is the place for you to join.